When a house fire strikes in Boise, families face more than charred walls and smoky odors. They confront the financial labyrinth of fire damage repair, insurance claims, and navigating the policies designed to protect them. Understanding how home insurance fire coverage aligns with actual repair costs in Boise is crucial for restoring safety and peace of mind.

Understanding Fire Damage and Coverage Basics

Fire doesn’t only char surfaces; it spreads invisible soot and smoke residue into every nook of a home. Structures can suffer heat-induced weakening, while water used by the Boise Fire Department to extinguish flames can introduce secondary damage like mold.

Home insurance fire coverage generally includes:

- Dwelling protection for structural repairs

- Personal property compensation for belongings

- Additional living expenses if the home is uninhabitable

- Liability coverage for damage to neighboring properties

Coverage limits, deductibles, and exclusions vary by policy. Boise residents should review their declarations pages to confirm specific fire-related protections.

Types of Fire Damage

Fire loss encompasses multiple perils that insurance adjusters categorize distinctly:

- Flame damage: Charring, consumed building materials, and melted fixtures.

- Smoke damage: Microscopic soot particles that stain drywall, infiltrate HVAC systems, and cause lingering odors.

- Water damage: Soaked carpets, swollen baseboards, and potential mold growth from firefighting efforts.

- Soot residue: Corrosive carbon deposits that can etch glass and ruin electronics.

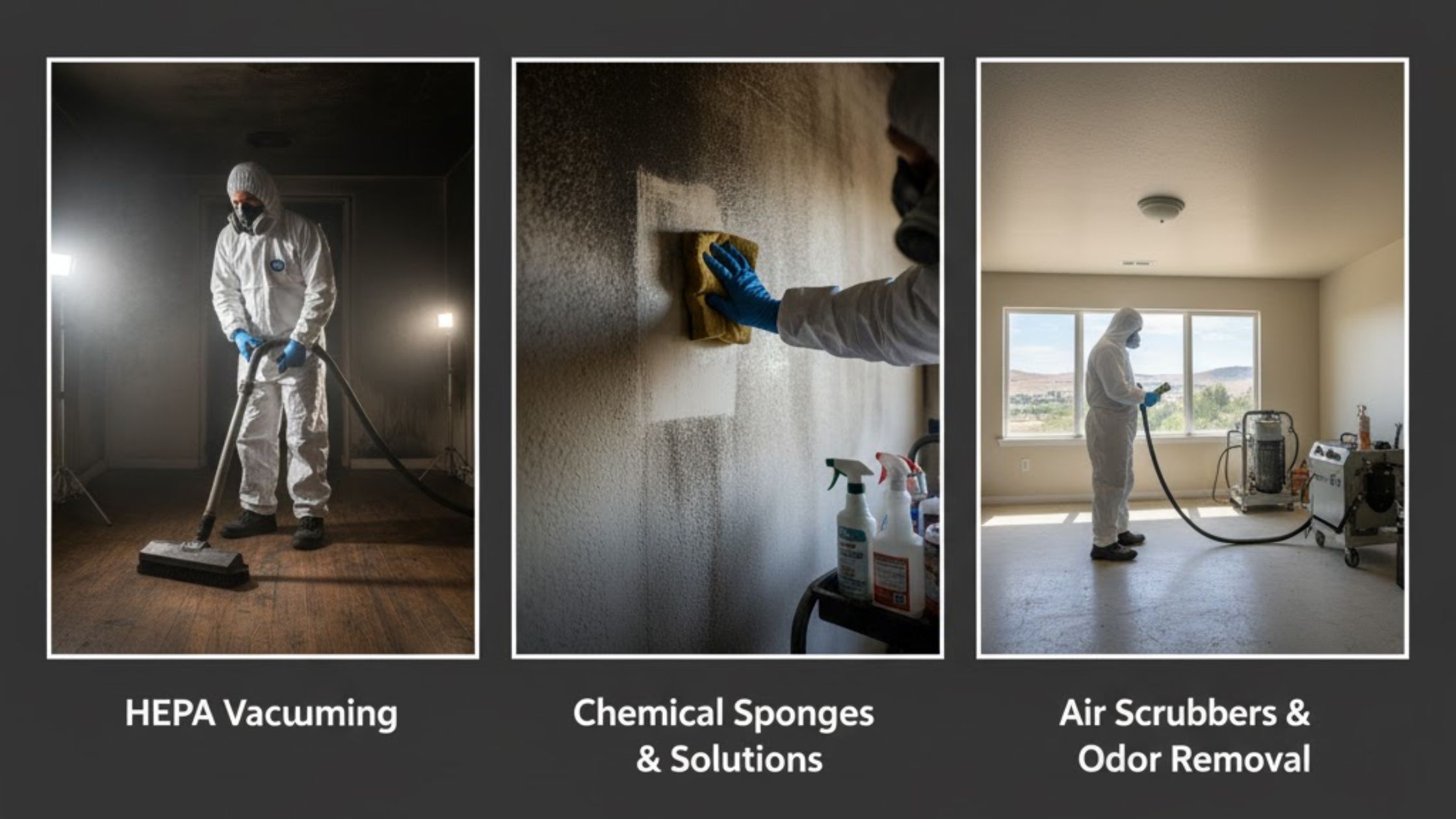

These damage types dictate different restoration methods, from dry-cleaning sponges and HEPA vacuums to ozone odor neutralization and thermal fogging.

Typical Home Insurance Fire Coverage in Boise

Homeowners insurance in Idaho usually covers sudden or accidental fire damage. Policies typically exclude wear-and-tear, intentional acts, and unattended heating equipment malfunctions. Wildfires may require additional wildfire endorsements if the primary coverage omits brush fire perils.

Below is a table summarizing common fire coverage elements found in Boise home policies:

| Coverage Type | Description | Boise-Specific Considerations |

|---|---|---|

| Dwelling Coverage | Repairs to structure (walls, roof, foundation) | Includes truss replacement after intense heat |

| Personal Property Coverage | Replacement of furniture, electronics, clothing | Actual Cash Value vs. Replacement Cost options |

| Additional Living Expenses | Hotel stays, meals, storage if home is uninhabitable | Boise’s winter months can spike lodging costs |

| Liability Coverage | Damages to other properties, medical costs for injuries | Neighbors’ homes in dense Boise neighborhoods |

Navigating Fire Insurance Claims in Boise

Filing a fire insurance claim can feel overwhelming. Boise residents benefit from understanding each step and organizing documentation before speaking to an adjuster.

Immediate Steps After a Fire Incident

- Ensure everyone’s safety and seek medical attention for injuries.

- Wait for clearance from the Boise Fire Department before reentering.

- Secure the property: board up windows, tarp damaged roofs.

- Photograph all damage, capturing fire, smoke, and water impacts.

- Compile a room-by-room inventory of destroyed or damaged items.

Taking these actions promptly protects against vandalism, weather exposure, and mold, while setting a solid foundation for a robust fire insurance claim.

Documenting Damage and Mitigation

Accurate documentation accelerates claim approval. Insurance adjusters look for:

- High-resolution photos of charred materials, soot patterns, and warped beams

- Videos showing water accumulation, mildew spots, and compromised electrical panels

- Receipts for emergency expenses like hotel stays, meals, and temporary storage

- Professional board-up and water extraction invoices

Performing mitigation—like running dehumidifiers to limit mold—demonstrates the homeowner’s due diligence. For complex multi-unit properties or historic Boise homes, hiring certified mold inspectors and structural engineers can prove indispensable.

Fire damage repair Boise becomes more efficient when homeowners present adjusters with meticulous records of both immediate actions and pending restoration needs.

Engaging with Insurance Adjusters

Insurance adjusters assess losses and negotiate settlement amounts. Working collaboratively helps ensure fair compensation:

- Remain courteous, factual, and persistent in follow-up communications.

- Request a written declaration of coverage limits and exclusions.

- Present independent contractor estimates, particularly for specialized services like smoke odor removal.

- Understand depreciation calculations affecting Actual Cash Value payouts.

- If applicable, exercise appraisal rights to engage a neutral umpire.

Clear, concise, and frequent updates build trust with adjusters, minimizing delays and disagreements.

| Claim Process Step | Homeowner Responsibility | Adjuster Role |

|---|---|---|

| Initial Notification | Call insurer, provide incident date | Assign claim number, schedule inspection |

| Damage Assessment | Supply documentation, inventory lists | Inspect property, document coverable losses |

| Estimate Negotiation | Submit contractor bids | Review bids, adjust for policy limits |

| Settlement and Payment | Confirm settlement offer | Issue funds, coordinate final walkthrough |

Selecting a Restoration Partner

Choosing the right restoration contractor ensures quality repairs and smoother insurance interactions.

Criteria for Choosing a Contractor

Boise homeowners should look for:

- IICRC-certified technicians for fire, smoke, and soot remediation

- 24/7 emergency response aligned with local fire and building codes

- Proven expertise in coordinating directly with insurers and adjusters

- Transparent pricing and detailed scopes of work

- References on similar Treasure Valley fire and smoke projects

Seamless Repair and Reconstruction Workflow

A comprehensive restoration partner handles both immediate mitigation and full-scale rebuilds. In many fire events, homes require structural carpentry, drywall replacement, and finishes. These reconstruction phases present an opportunity to update layouts or upgrade systems. Effective contractors manage sub-trades and coordinate permits, all while keeping clients and insurers informed.

Reconstruction Services in Boise firms versed in local building regulations can expedite inspections and certifications, reducing out-of-pocket expenses and minimizing home displacement time.

Restoration extends beyond a fresh paint job—specialized equipment like hydroxyl generators, air scrubbers, and commercial dehumidifiers tackles hidden pockets of soot and moisture. Structural engineers test load-bearing joists for heat damage, while indoor air quality experts perform post-repair clearance testing. These layered services align with Boise’s plumbing, electrical, and HVAC codes.

Next Steps for Boise Homeowners

Once coverage is confirmed and contractors are selected, homeowners should:

- Review and sign detailed scopes of work that align with insurer approvals

- Track project milestones: mitigation, structural repair, cosmetic finishes

- Maintain a daily job log noting completed tasks and outstanding items

- Coordinate final walk-throughs with both adjusters and restoration teams

- Collect lien waivers and final invoices before lock-out release

A transparent process helps prevent scope creep and out-of-pocket surprises.

In the aftermath of a blaze, the question “Will my policy actually cover these repairs?” transforms into “Which trusted professionals will rebuild safely and swiftly?” Consulting resources on Fire Damage Repair in Boise Homes can guide homeowners toward vetted specialists familiar with local nuances.

Frequently Asked Questions

1. Does homeowners insurance in Boise cover fire damage repairs?

Yes. Standard policies cover sudden or accidental house fires, including structural repairs and smoke remediation, subject to policy limits and deductibles.

2. How do I file a fire insurance claim in Boise?

Report promptly to your insurer, document all damage with photos and receipts, secure the property, and work with the assigned adjuster to negotiate a fair settlement.

3. What is the average time frame for insurance to approve fire damage repairs?

Initial inspections typically occur within 24–72 hours of notification. Full claim resolution can range from 2 to 8 weeks, depending on damage complexity and documentation quality.

4. Should I hire a public adjuster or work directly with the insurance company?

While public adjusters can boost settlement amounts, they charge a contingency fee (usually 10%–15%). Direct negotiations can suffice for smaller claims if homeowners provide thorough documentation.

5. What should I do if my claim is underpaid or denied?

Review your policy, request a detailed explanation for any denial, gather additional evidence, and consider mediation or appraisal processes. Legal counsel or state insurance commissioners can also assist.

Conclusion

In Boise, the interplay between comprehensive restoration services and robust home insurance fire coverage can determine how quickly families return to normal life. By understanding policy provisions, documenting damage meticulously, and partnering with certified mitigation and reconstruction experts, homeowners can manage costs, streamline approvals, and rebuild stronger.

For trusted fire damage evaluations, smoke odor removal, and full reconstruction support in Boise, reach out to Sawtooth Water Restoration—your local authority in restoring homes after fire emergencies. We specialize in guiding you through every claims step, ensuring a secure, efficient recovery for your Boise residence.