When fire engulfs your home, the burning question is not just who will restore your property, but whether insurance will step in to shoulder the cost. In Boise, Idaho, understanding what your homeowner’s policy covers, what exceptions may apply, and how to navigate the claim process is essential. Throughout this guide, we’ll explain how fire damage coverage works, what your policy may include, how to file a claim, and how Sawtooth Water Restoration supports you every step of the way when fire damage restoration in Boise becomes necessary.

Does homeowner’s insurance in Boise cover fire damage?

Yes, in most cases, homeowner’s insurance policies in Boise include fire damage coverage as part of their standard protection. That coverage generally applies to sudden and accidental fires, including structural damage, smoke damage, and many associated costs. However, like all insurance contracts, coverage has limits, exclusions, and requirements you must meet.

Policies typically cover:

- Dwelling protection: repairs to the home’s structure — walls, roof, foundations, framing, damaged by fire or heat.

- Personal property coverage: replacing or repairing your belongings — furniture, electronics, clothing — damaged by fire, smoke, or water from firefighting.

- Additional living expenses (ALE): costs you incur if your home becomes uninhabitable (hotel, meals, storage) while repairs are underway.

- Liability protection: legal and medical costs if fire or smoke from your property damages a neighbor’s property or causes injury.

However, the exact scope depends on your policy type (HO-3, HO-5, etc.), endorsements, and specific clauses. Your declarations page will indicate how much your insurer will pay, what your deductible is, and which types of fire perils are covered.

What limitations, exclusions, or special conditions might apply?

While fire is usually a covered peril, policies generally exclude or limit coverage under certain conditions. Understanding these limitations is essential to prevent surprises.

1. Intentional acts or neglect

If investigations show the fire was intentional, or caused by gross negligence (e.g. leaving a candle unattended in violation of safety rules), coverage may be denied.

2. Maintenance issues and wear & tear

Damage that results from poor maintenance (wiring failure over time, neglected chimney cleaning, old appliances) might not qualify. Insurers expect you to maintain basic safety.

3. Wildfire and brush fire risk

Standard policies often cover wildfire, but some insurers may exclude or limit coverage in high wildfire zones unless you carry a wildfire endorsement or special riders. In Idaho, insurers are increasingly reevaluating wildfire risk in Boise and nonrenewing policies in fire-prone areas.

4. Secondary damage from delay

If you wait too long to mitigate after a fire, insurers may refuse coverage for damage like mold growth, corrosion, or structural collapse that occurs later.

5. Valuation and depreciation

Insurers may pay actual cash value (ACV) instead of replacement cost until you upgrade or meet certain requirements. Depreciation may reduce what you actually receive.

6. Excluded perils

Some policies exclude damage from smoke from agricultural fires, soot from unpermitted repairs, or damage from wildfires unless your policy explicitly includes them.

7. Limits on coverage

Your policy may limit coverage for items like jewelry, art, business property, or contents beyond certain dollar limits unless you carry additional coverage.

8. High deductibles

Some homes in high-risk zones face fire deductibles (a higher deductible specifically for fire losses) that may be dozens of percentage points of your insured amount.

Because of these potential limitations, it is vital to read your policy carefully, review endorsements, and ask your insurance agent detailed questions.

How to file a fire damage claim in Boise: step by step

Filing a claim the right way maximizes your recovery, minimizes denials, and keeps your restoration project moving. Below is a helpful roadmap.

1. Report the claim immediately

Call your insurer as soon as possible. Delay may cause complications or objections. Getting the claim on record early helps lock in your timeline.

2. Secure the property and mitigate further damage

You should board up, place tarps, and perform limited stabilization. Insurers typically allow reasonable mitigation costs so long as you document them. Not doing so may jeopardize parts of your claim.

3. Document everything

Use high-resolution photos, video, and notes. Capture structural damage, soot patterns, water intrusion, and affected belongings. This documentation is your evidence for adjusters.

4. Prepare an inventory of lost or damaged items

Room-by-room lists with descriptions, purchase dates, and approximate values help substantiate your content claim.

5. Meet with the insurance adjuster

The adjuster will assess damage, review your documentation, and issue a scope of work. Be present to ask questions and make sure hidden damage (smoke behind walls, ductwork contamination) is noted.

6. Review settlement offers and scope

Compare adjuster’s proposals to your own contractor estimates. Be ready to negotiate or present second opinions on smoke remediation, structural repairs, and content restoration.

7. Begin restoration work

Once you and the insurer agree, the restoration team (such as Sawtooth Water Restoration) begins repair, cleanup, odor removal, and reconstruction.

8. Keep detailed records of all invoices, change orders, and communications

Insurers may audit or request further proof. Close everything carefully before finalizing payment.

9. Final walkthrough and payment

Walk through completed work with your insurer and contractor. Confirm satisfaction before accepting final payments and signing off.

Working with a restoration company experienced in insurance claims ensures fewer surprises, faster approvals, and more complete coverage.

What aspects of fire damage are often underpaid or denied?

Claims don’t always cover the full cost, especially in smoky, structural, or content-sensitive situations. Here are things often underpaid or denied:

- Smoke penetration behind walls, inside insulation, ductwork, or in crawlspaces

- Odor removal treatments, thermal fogging, ozone, hydroxyl or activated carbon filtering

- Electronics or appliances “apparently okay” but contaminated by soot

- Undocumented content or missing receipts

- Emergency board-up, tarping, and temporary repairs

- Water damage from firefighting

- Reconstruction to modern codes or upgrades

- Additional living expenses beyond limited days

- Depreciation, unless you have replacement-cost coverage

A restoration company with claims experience can help justify these items to the insurer and recover proper payment.

Why partnering with Sawtooth Water Restoration helps your claim

When fire damage strikes, you deserve a team that knows both restoration and insurance. Sawtooth Water Restoration offers more than cleanup—we act as your advocate during the claims process.

- We document damage thoroughly and present unbiased scopes

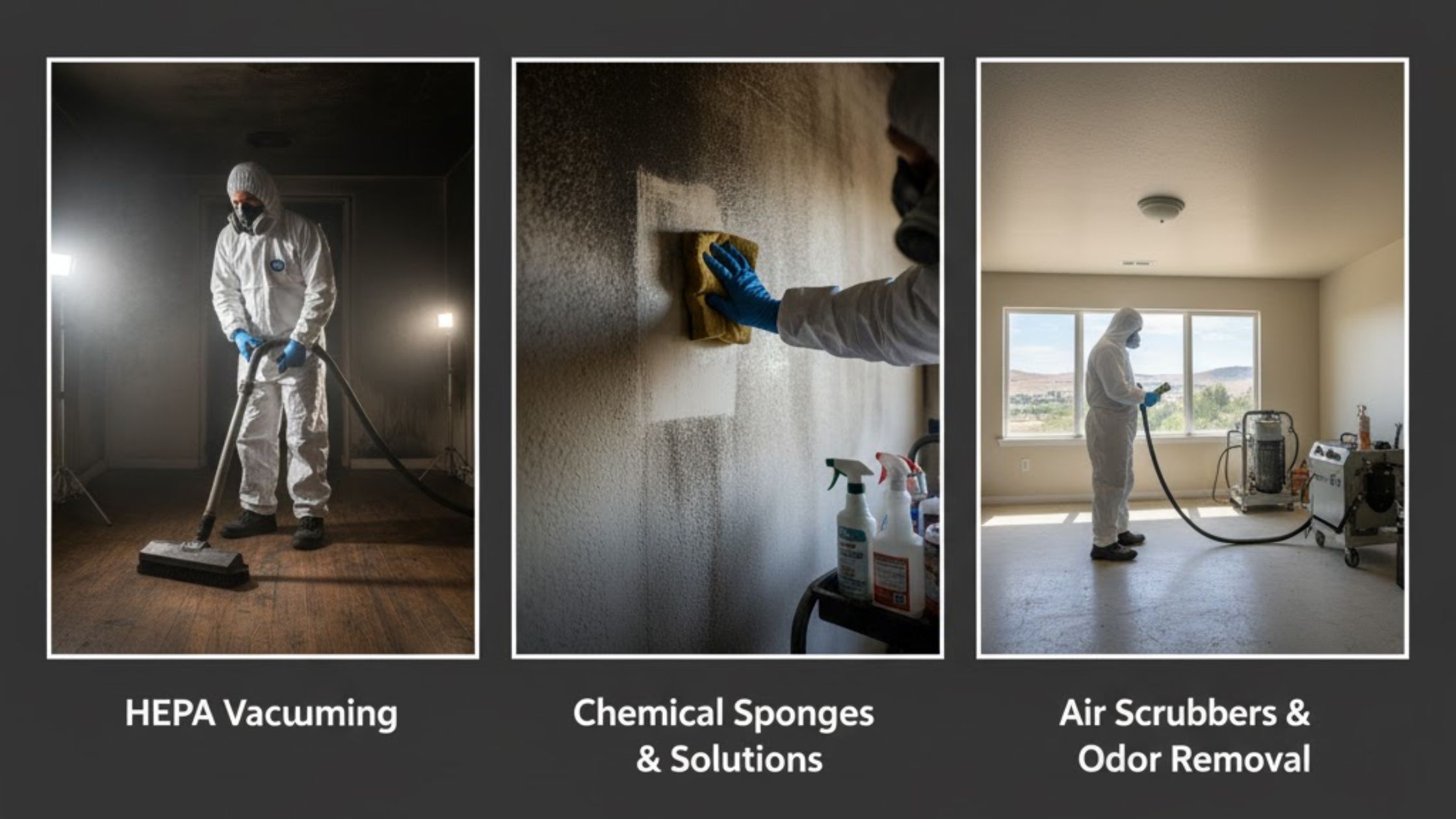

- Our IICRC-certified technicians provide professional smoke, soot, and fire remediation estimates

- We coordinate directly with adjusters, submitting backup documentation and responding to inquiries

- We ensure hidden damage (behind walls, HVAC, ductwork) is included

- We handle reconstruction per Boise codes to satisfy permit and inspection requirements

- We support you during settlement disputes or scope disagreements

This comprehensive approach gives you the best chance of full recovery with minimal stress.

Local and statewide insurance trends in Boise, Idaho

Idaho is seeing a shifting insurance landscape. Due to escalating wildfire risk, many insurers are pulling back from certain areas or nonrenewing policies altogether.

In Boise’s foothills and urban-wildlife interface zones, residents report sky-rocketing premiums or cancellation notices.

The state legislature has introduced bills aimed at creating a Wildfire Risk Mitigation Fund or other stabilization mechanisms to help homeowners retain affordable coverage.

Idaho does not have a FAIR Plan (a last-resort insurer) to guarantee coverage for high-risk homes.

Given these shifts, keeping up with your policy, making mitigation improvements (home hardening), and having a restoration company that understands Idaho’s insurance climate are vital.

FAQs: People also ask about fire damage insurance in Boise

Q1: Does homeowners insurance always cover wildfire damage in Boise?

Often yes, but it depends on your policy. Some insurers exclude or limit wildfire coverage unless you carry a specific endorsement.

Q2: Will insurance cover smoke damage if the fire was on a neighbor’s property?

Possibly. Some policies cover damage from external fire or smoke under liability or extra coverage clauses, but this depends on your specific policy terms.

Q3: What is the typical turnaround time for fire insurance claims in Boise?

Minor claims may begin within 24–72 hours. Complex claims involving structural damage, content restoration, or disputed items can take 2 to 8 weeks or more.

Q4: If insurance denies part of my claim, what can I do?

Ask for a detailed explanation, engage in review or appraisal process, hire a public adjuster, or file a complaint with the Idaho Department of Insurance.

Q5: Does making safety improvements to my home help with fire coverage?

Yes. Home hardening measures like Class A roofs, ember-resistant vents, defensible space zones, and maintained gutters may lower risk and help secure or retain coverage.

Conclusion

Yes, in Boise, fire damage is generally covered by homeowner insurance if the fire was sudden and accidental and you maintain proper coverage. But many caveats, exclusions, and policy limitations mean you must do your homework. That is why having a restoration partner like Sawtooth Water Restoration is invaluable. We guide you through claims, document meticulously, work with adjusters, and restore your home fully. If your property is affected by fire, reach out via our Contact us page and let our team advocate for you and restore your home with integrity.